Ein Number Georgia

This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. The phone number for the Business Specialty Tax Line is 800-829-4933.

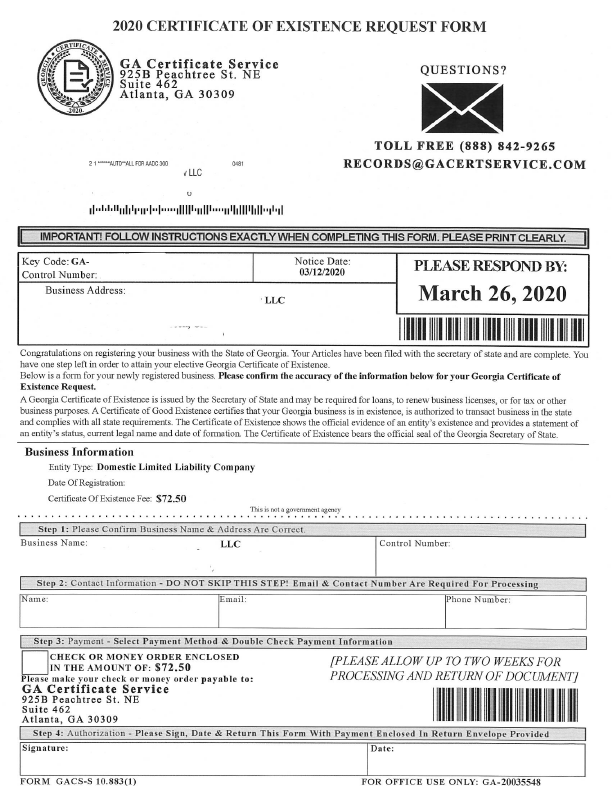

New Business Scam Certificate Of Existence Grissom Law Llc

Suite 313 Floyd West Tower Atlanta GA 30334-1530 Phone.

Ein number georgia

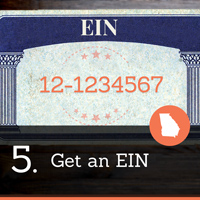

. If the company. Office of the Georgia Secretary of State Attn. Having an EIN for your Georgia LLC allows you to open a separate bank account under the LLCs name apply for certain licenses and permits and handle employee payroll if applicable. An Employer Identification Number EIN in Georgia is a nine-digit number that the IRS assigns in the following format.Businesses in Georgia must register for a federal employer identification number and a state taxpayer identification number and register as a business with the Georgia Secretary of State. No matter what you choose though youll need a federal tax ID number also called an Employer Identification Number or Georgia EIN to establish the identity of your business separate and apart from your personal one. Enter the name or number required you wish to search. Once you have been issued your tax ID number the IRS will send you a notification and you will receive via mail your official EIN number Georgia confirmation.

File for Georgia EIN. Trying to efile return but program want Georgia DOR EIN number for 1099g because there is a Georgia state return along with SC return. An EIN is to your Georgia LLC what a Social Security Number is to a person. Even for businesses and entities that are not required to obtain a Tax ID EIN in Georgia obtaining is suggested as it can help protect the personal information of the individuals by allowing them to use their Tax ID.

You may apply for an EIN in various ways and now you may apply online. The process to do this is fairly straightforward though you do have a few options that could make it easier or harder. Georgia Code First Stop Business Information Center SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. It is similar to a personal social security number in that it is used to obtain credit open bank accounts and handle other similar tasks.

The most common reasons a business in Georgia will need to register for a state business tax numbers include. To open a corporate bank account you will need to take your Georgia certificate of. Select the Search button. 51 Zeilen Numbers რიცხვები ritskhvebi in Georgian a South Caucasian language spoken in.

It is used to identify the tax accounts of employers and certain others who have no employees. To get one youll need to register your business with the federal government. Client did not have a refund from Georgia last year. It also is required if you have employees and to pay taxes.

An IRS representative will ask you some qualifying questions to confirm business ownership or to verify that youre authorized to be provided with the EIN. However for employee plans an alpha for example P or the plan number eg 003 may follow the EIN. It is a number specifically assigned to your business by the Georgia government for licensing or tax purposes according to the Georgia Department of Revenue. Generally businesses need an EIN.

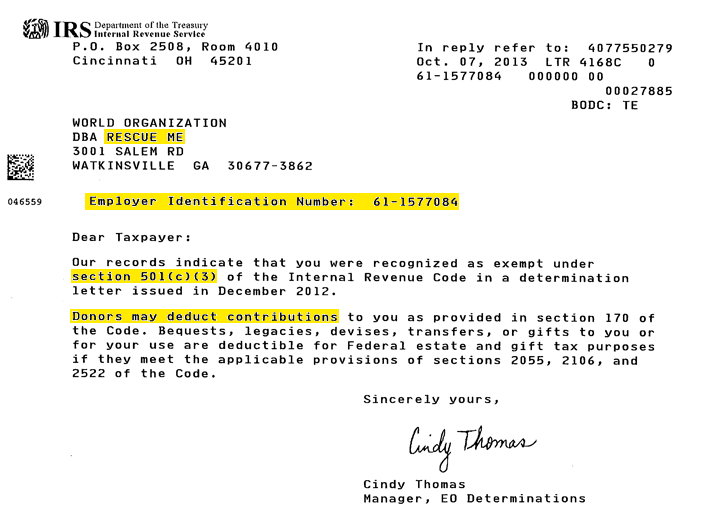

Uses of Georgia Tax ID EIN Numbers. Learning how to get a tax ID number in Georgia is not difficult but the process can be if you go through the IRS. Your sales tax ID number is also called an employer identification number or state taxpayer identification number. Business tax numbers in Georgia are often confused with the Employer Identification Number.

Most Georgia businesses will need a tax ID number also called an employer identification number EIN or FEIN. After receiving your federal employer identification number for your Georgia company you are now in a position to open up a business bank account. Obtaining a Georgia Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete. The EIN is a separate number that is used to federally register a business with the Internal Revenue Service IRS and may be needed in addition to state tax numbers.

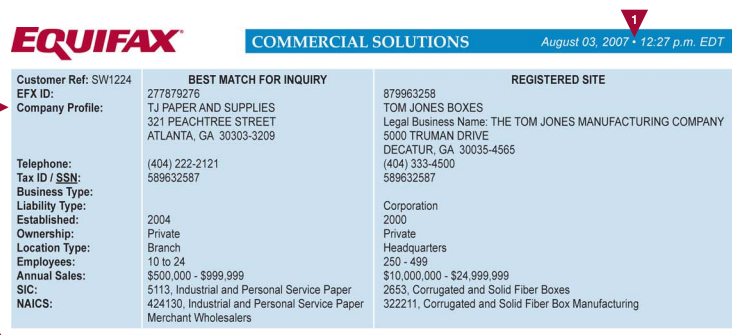

There are four ways to do a Georgia tax ID number. Keep in mind that Mondays are the busiest days to call the IRS. If you are trying to find the EIN of business other than yours there are a few options. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

A Georgia tax ID number is a basic identification number for your business. A Georgia employer identification number also called a state taxpayer identification number is a unique number that the Georgia government assigns to businesses for tax or licensing purposes. It helps the IRS identify your business for tax and filing purposes.

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Llc Georgia How To Start An Llc In Georgia Truic

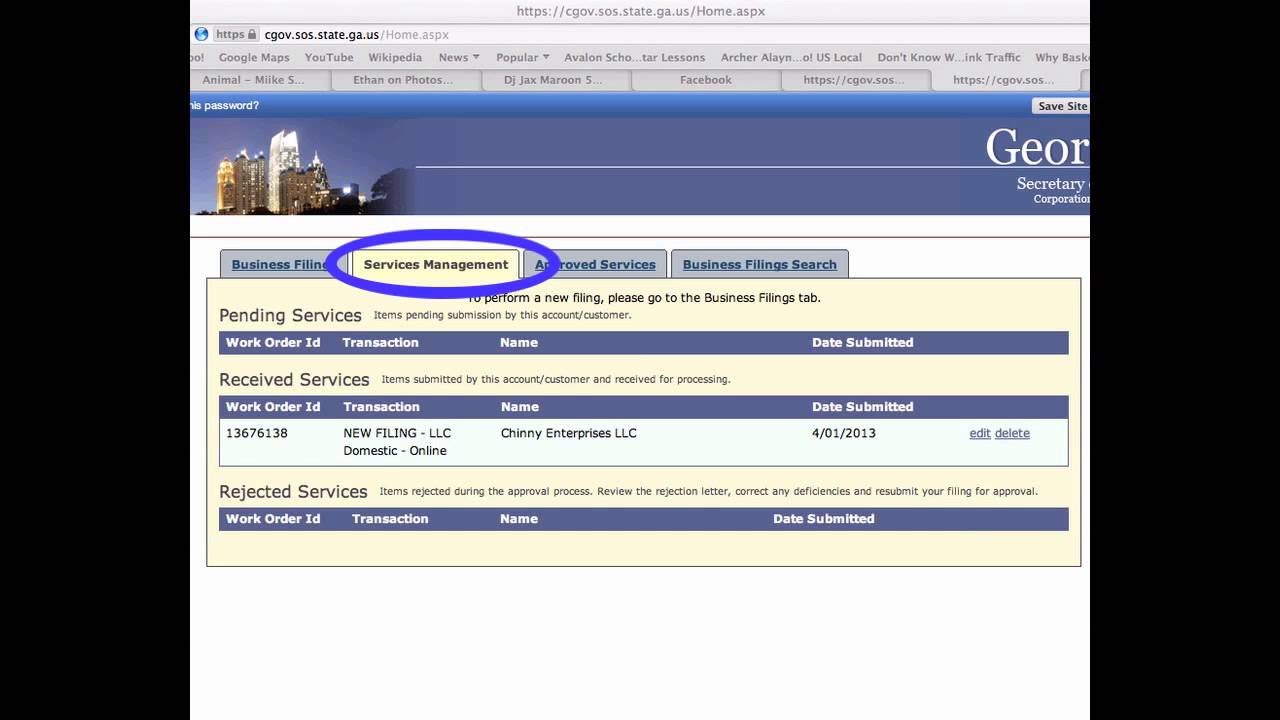

How To Search Available Business Names In Georgia Startingyourbusiness Com

Do I Need A Tax Id Number For My Business

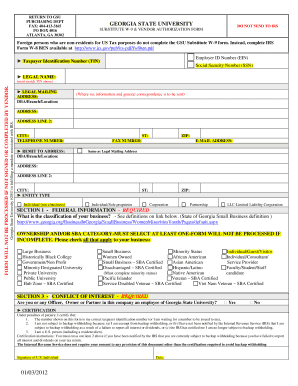

Ga Dor St 5 2016 2021 Fill Out Tax Template Online Us Legal Forms

Https Hr Gatech Edu Sites Default Files Documents Payroll Understanding Your W 2 2019 Pdf

Georgia Tax Id Ein Number Application Business Help Center

Locate Your Individual Registration Number For Child Support Services Georgia Department Of Human Services

Https Dph Georgia Gov Document Document Form W 9 Request Taxpayer Identification Number And Certification Download

Solved A Richard Mccarthy Born 2 14 64 Social Security Number 100 10 9090 Solutioninn

Llc Georgia How To Start An Llc In Georgia Truic

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

Learn How To Fill Out A W 9 Form Correctly And Completely

How To Get A Tax Id Number For A Business Financeviewer

How To Search Available Business Names In Georgia Startingyourbusiness Com

Georgia State University Federal Id Number Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Ein Number Georgia"